The public issue may be Initial Public Offering (IPOs) or Follow on public Offer (FPOs).

Initial Public Offering (IPO) In initial public offering (IPO), the unlisted Company makes either fresh issue of shares or offer for sale of the exiting shares. It is the first sale of shares and debentures by a company to the public and a closely held Company being transformed into a widely held Company

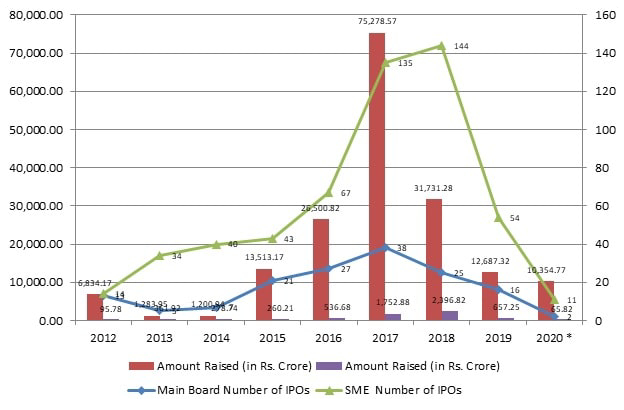

IPOs on Main Board and SME Board and Funds raised

The Regulatory Framework for IPOs is broadly contained in the following Acts, Rules and regulations:

The above list is not exhaustive and there are some other regulations which are required to be complied with while coming out with an IPO.

In case the issue is made through book-building, the issuer undertakes to allot at least 75 % of the net offer to qualified institutional buyers and to return the full subscription money if it fails to make this allotment.

Following guidelines are provided under Chapter IX of SEBI (ICDR) Regulations 2018

| S.No | Main Board IPO | SME IPO |

|---|---|---|

| 1 | Post Issue Capital more than 10 Crore | Post Issue capital should not exceed Rs. 25 Crore. |

| 2 | IPO Grading is mandatory | NA |

| 3 | Minimum no. of allottees 50 | Minimum no. of allottees 50 |

| 4 | Minimum Application Value is Rs. 10000-15000 | Minimum Application Value is Rs. 100000/- |

| 5 | Underwriting of issue is optional. | 100% underwritten issue. |

| 6 | Offer document is filed to SEBI for Vetting. | Offer document is filed to Stock Exchange for Vetting. |

| 7 | No requirement of market making. | Market making is compulsory. |

CCV provides full-fledged services for businesses seeking to list on stock exchange under Main Board & SME IPO. Our professional team prepares all the documents including the prospectus, files the applications, helps in acquiring investors to raise capital, and all related activities for submission of your company to the stock exchange in the shortest time. We follow a proven approach to cope with the market challenges and help companies adjust to the public infrastructure.

Under this phase, we shall assist you in preparation of IPO and listing. Our scope of services under this phase shall mainly include Advisory in the following:

Under this phase, we shall carry out a due diligence and our scope of services shall mainly include the following:

Under this phase, we shall carry out valuation exercise and our scope of services shall mainly include the following:

Under this phase, we shall give observations on IPO Offer Document and other important agreements, documents and resolutions necessary for an IPO process. An indicative list of important documents is as under for easy understanding:

We shall assist in complete end-to-end IPO process including the following activities:

Finally, post IPO closure and finalization of allotment; we shall initiate the activities for listing of equity shares of the Company on SME Exchange. We shall advise in the following activities under this phase:

We handhold the Company and Management throughout the Process of getting their Company Listed on Stock Exchanges and raise funds through IPO.

Valuation is a process of appraisal or determination of the value of certain assets: tangible or intangible, securities, liabilities and a specific business as a going concern or any...

Stock buybacks indicate to Re-purchasing of Securities by the organization that have issued them. In buybacks generally Issuer Companies return to its investors Price more than the market price per share.

A takeover Offer is a type of action in which a an offer is being made to acquire another Listed Company. It could be made by an Individual or a Group or Any Legal Entity, which is known as the acquirer,

The process of taking a company’s shares off the stock exchange is delisting. A Listed company desirous of getting unlisted must Delist its shares through an open offer

A business grows over time as the utility of its products and services is recognized, but it may also grow through an inorganic process, symbolized by an instantaneous expansion in work force,

Employee Stock option Plan (ESOP) is a corporate strategy for retaining and motivating employees. Under which a company gives its employees the right to buy a certain number of shares at a fixed price (grant)