but it may also grow through an inorganic process, symbolized by an instantaneous expansion in work force, customers, infrastructure resources and thereby an overall increase in the revenues and profits of the entity.

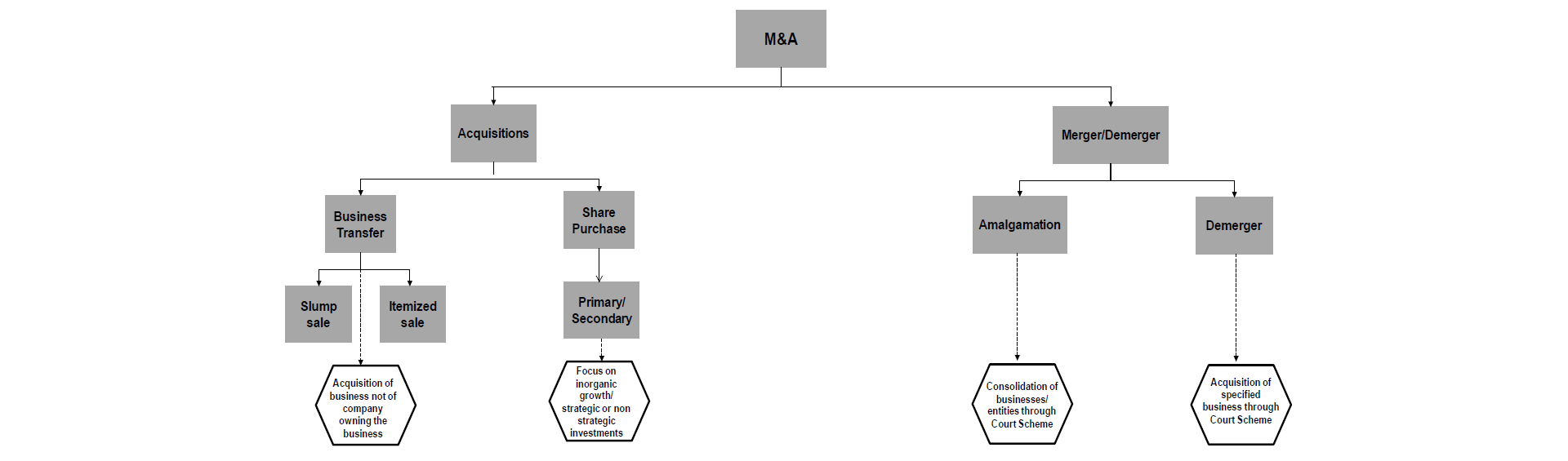

Mergers and Acquisitions (M&A) are quite important forms of inorganic growth. While mergers can be defined to mean unification of two players into a single entity, acquisitions are situations where one player buys out the other to combine the bought entity with itself.

Access to new technologies and systems.

Access to synergistic products and/ or services.

Broader geographical penetration.

Reducing competitive tension in consumer markets.

We assist our clients with many aspects of the M&A process including

With years of expertise and in depth industry knowledge and contacts, we are able to provide clients with strategic advice in accessing deal flow.

With our multidisciplinary approach, we carry out legal and financial due diligence with an industry specific focus.

Based on our industry experience and team of experts we carry analyses of Revenue Synergy, Cost Synergy and Financial Synergy by considering perspective effect of M&A.

M&A transactions involve various aspects of corporate and securities laws, tax compliance, exchange control laws, stamp duty implications and instruments drafting etc. Our team of professional assist you in regulatory clearance and support in legal matters.

With our rich experience we will hand hold the client from inception till the deal closure during M&A transactions. Our team of professional will guide the client throughout the transaction about all strategic decisions and assist in raising funds for the transaction.

When valuing a business or company, an understanding of financial elements is not enough. Our valuation team understand that each business and company is unique, and our valuation reports take this into account.

CCV is passionate about supporting small and medium enterprises through succession and acquisition in a way that is practical, personalised and results-focused. We offer end-to-end support on company acquisitions and sales.

We undertake regular discussions with a large number of buyers and sellers including private and institutional investors as well as private equity firms. These discussions give us excellent insight with respect to their M&A appetites as well as their acquisition and divestment goals. Based on our industry experience CCV supports its clients in all phases of the transaction process.

We handhold the Company and Management throughout the Process of getting their Company Listed on Stock Exchanges and raise funds through IPO.

Valuation is a process of appraisal or determination of the value of certain assets: tangible or intangible, securities, liabilities and a specific business as a going concern or any...

Stock buybacks indicate to Re-purchasing of Securities by the organization that have issued them. In buybacks generally Issuer Companies return to its investors Price more than the market price per share.

A takeover Offer is a type of action in which a an offer is being made to acquire another Listed Company. It could be made by an Individual or a Group or Any Legal Entity, which is known as the acquirer,

The process of taking a company’s shares off the stock exchange is delisting. A Listed company desirous of getting unlisted must Delist its shares through an open offer

A business grows over time as the utility of its products and services is recognized, but it may also grow through an inorganic process, symbolized by an instantaneous expansion in work force,

Employee Stock option Plan (ESOP) is a corporate strategy for retaining and motivating employees. Under which a company gives its employees the right to buy a certain number of shares at a fixed price (grant)