Mergers and Acquisitions

A business grows over time as the utility of its products and services is recognized, but it may also grow through an inorganic process, symbolized by an instantaneous expansion in work force, customers, infrastructure resources and thereby an overall increase in the revenues and profits of the entity.

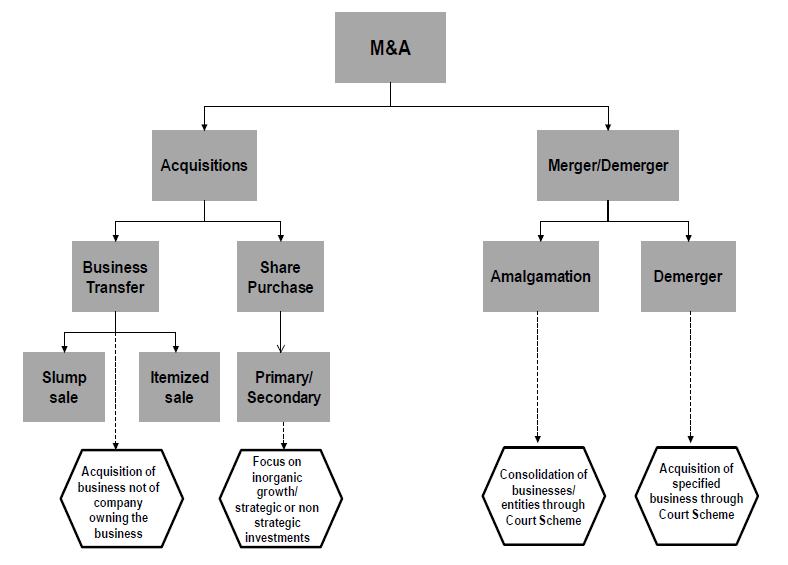

Mergers and Acquisitions (M&A) are quite important forms of inorganic growth. While mergers can be defined to mean unification of two players into a single entity, acquisitions are situations where one player buys out the other to combine the bought entity with itself.

Services Offering in M&A

We assist our clients with many aspects of the M&A process including:

Strategic Advisory

Due Diligence

Synergy Analysis

Deal Structuring

Deal Execution

Valuations

CCV in Deal Transactions

CCV is passionate about supporting small and medium enterprises through succession and acquisition in a way that is practical, personalised and results-focused. We offer end-to-end support on company acquisitions and sales.

We undertake regular discussions with a large number of buyers and sellers including private and institutional investors as well as private equity firms. These discussions give us excellent insight with respect to their M&A appetites as well as their acquisition and divestment goals. Based on our industry experience CCV supports its clients in all phases of the transaction process.

Public Issue

We handhold the Company and Management throughout the Process of getting their Company Listed on Stock Exchanges and raise funds through IPO.

Valuation & Business Modelling Services

We make decision making simple by Assessing Valuation of Shares/Business in addition to Compliance of Regulatory requirements. We are also specialised in 409a valuations.

M&A Advisory

We as Intermediaries of Transaction make sure that both the parties are in a win-win situation within the scope of Applicable Laws.

Services under IBBI

We act as Deal makers for ‘to be Insolvent companies’ by fuelling necessary support at appropriate time and creating opportunities for our Investors

ESOP Advisory Services

We as ESOP Advisors formulate schemes favourable to both Employers and Employees and make sure smooth implementation.

Corporate Restructuring

We advise our clients to have the most appropriate Corporate structure best suited with the organisation.

Fund Raising Services

We raise funds both through Equity and Debt for Start Ups and Sustained Businesses through various platforms.

Business Acquisition Services

We help our clients to find out Listed/ Unlisted Companies in various businesses, Due Diligence of Target Companies and structuring deals for them.