Direct Overseas Listing

Of Indian Companies

CORPORATE CAPITALVENTURES PRIVATE LIMITED

SEBI Registered Category I Merchant Banker

A Brief On Overseas Listing

At present, Indian companies can access the overseas equity markets only

through depository receipts (e.g. American Depository Receipts or Global

Depository Receipts regime) or by listing their debt securities (such as, foreign

currency convertible bonds, masala bonds, etc.) on foreign markets.

On the stock exchanges of the United States, for instance, a company may list

its shares through a public offering, inviting American investors to subscribe to

its shares, or through ‘direct listing’, by merely joining a stock exchange without

raising capital.

Advantages Of Overseas Listing

Besides the obvious

advantage of

having access to

an abundant

alternative source

of capital, overseas

listing provides

other advantages

to Indian

companies.

| Better Valuation |

| Broader Investor Base |

| Global Brand Recognition |

| Alternate Source of Foreign Currency |

| International Expansion |

| Better Corporate Governance |

Indian Co. Listed Overseas

| Company | National Stock Exchange (INR) | NYSE (USD) |

|---|---|---|

| Infosys | 800 | 10.47 |

| HDFC | 1080.25 | 47.02 |

| ICICI | 353.6 | 9.43 |

| Dr. Reddy | 3898 | 51.39 |

Indian Law Related To Overseas Listing

- Companies Act, 2013

- COMPANIES (AMENDMENT) BILL, 2020

- Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004;

- Foreign Exchange Management (Deposit) Regulations, 2016;

- Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017;

- SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018;

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015;

- Other related SEBI Regulations.

Companies (Amendment) Bill, 2020

Before the bill

-

1. Indian companies used to list

overseas only through depository

receipts

2. Companies to get listed overseas

had to have at least 10% of the paidup capital be listed on Indian stock

exchanges, the issue size set at a

minimum of Rs.1,000 crore, and

allotment made to at least 200

investors

3. They were also allowed to list their

debt securities on foreign stock

exchanges directly through masala

bonds and foreign currency

convertible bonds.

About the Bill

The Government of India, on 17

March 2020, introduced the

Companies (Amendment) Bill,

2020 (Bill) in the Lok Sabha that

provide for Indian companies to

list securities directly on overseas

stock exchanges.

After the bill

- 1. Indian companies after the bill

can get directly listed on the

foreign stock exchange.

2. This will help Indian

companies get access to

multiple jurisdictions for raising

capital, with differing costs and

listing conditions.

3. This will also help Indian

companies to get higher

valuation

The corporate affairs ministry

and SEBI is yet to announce

norms on the types of

companies that can list

overseas.

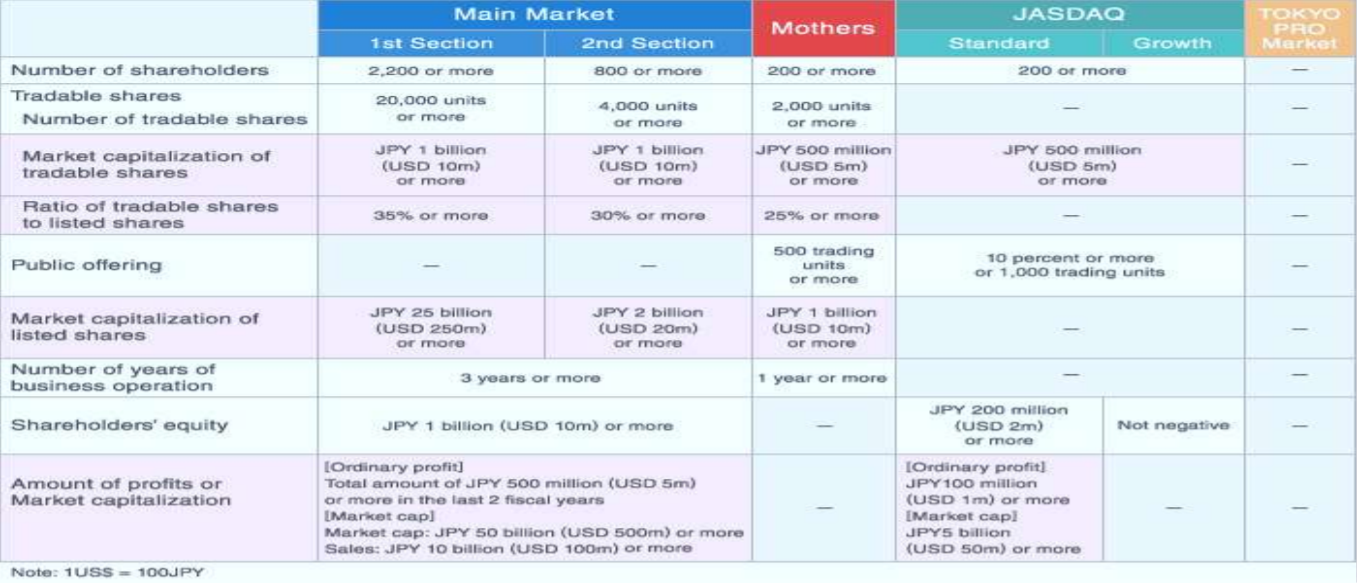

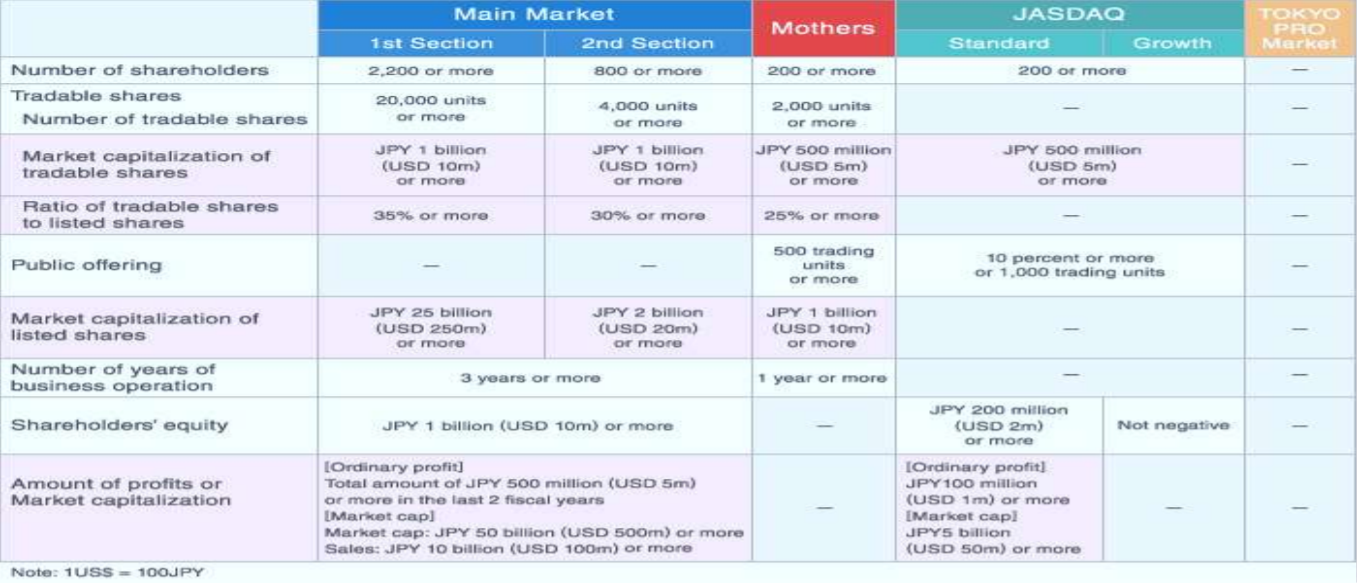

Japan Stock

Exchange

Requirements For Indian Companies For Listing On Stock Exchange In Japan

There are two types of requirements :

Formal

Requirement

Eligibility Requirements

TSE examines the company, which meets “Formal Requirements” and conducts an examination on in under

“Eligibility Requirements.”

Formal Requirements

Eligibility Requirements

Listing Fees For First And Second Section

Listing examination fee: JPY 4 million

Initial listing fee:

- JPY 15 million (First Section);

- JPY 12 million (Second Section).

Public offering / sales fee:

- Number of offered shares x the offering price of new shares x 0.0009;

- Number of existing shares offered x offering price x 0.0001.

Annual listing fee:

- JPY 0.96 to 4.56 million (First Section);

- JPY 0.72 to 4.32 million (Second Section).

Taxation Policy

| Taxes | Rate |

|---|---|

| Corporate income tax rate | 23.2% (30%-34% including local taxes) |

| Capital gains tax rate | 23.2% (30%-34% including local taxes) |

| Dividend Distribution tax | 20% (20.42%including surtax |

Listing Fees For Mothers Or TSE

Listing examination fee: JPY 2 million

nitial listing fee: JPY 1 million;

Public offering / sales fee:

- Number of offered shares x the offering price of new shares x 0.0009;

- Number of existing shares offered x offering price x 0.0001;

Annual listing fee: JPY 0.48 to 4.08 million (half for the first 3 years after listing).

Why To Register On Tokyo Stock Exchange?

- Smooth and Diversified Fundraising

- Enhance Corporate Value

- Improve its Internal Management System and Enhance the Employees’ Motivation

Foreign Companies Listed In Japan

| Company | Industry | Company | Industry |

|---|---|---|---|

| Tech point Inc | Electric Appliances | California, United States | Mothers |

| Beat Holdings Limited | Information & Communication | Cayman Islands | Jasdaq |

| MediciNova,Inc. | Pharmaceutical | United States | 2nd Section |

| YTL Corporation Berhad | Construction | Malaysia | 1st Section |

Shanghai Stock Exchange

Requirements For Indian Companies For Listing On Stock Exchange In China

- 1. China has previously not allowed foreign companies to get listed on its stock

exchanges. But In June 2017, China came with a decision to allow the overseas

companies to be listed on a Chinese stock exchange.

- 2. UK and China formed an alliance and It’s all part of an unprecedented

investment link between the two countries’ stock exchanges that they proceed to

form a stock connect Known as the London-Shanghai Stock Connect, a

connectivity mechanism between SSE and LSE at the initial stage.

- 3. The Shanghai-London Stock Connect allows eligible companies listed in each

market to issue depository receipts (DRs) on the other exchange.

Requirements For Indian Companies For Listing On Stock Exchange In China

- 4. Eligible brokers in both China and UK may apply for the license to conduct

cross-border conversion in accordance with the relevant regulations.

- 5. The issuance and listing of Shanghai-London Stock Connect DRs are subject to local regulatory requirements, and issuers are required to fulfil their

information disclosure obligations.

- 6. Presently no foreign company is listed on this stock exchange. No specific requirements for listing are being communicated so far.

Introduction Of Otc Market

Definition: A decentralized market where participants

trade securities directly between two parties without a

central exchange or broker electronically

Features:

1. Dealers act as market-makers by quoting prices at

which they will buy and sell a security

2. Companies which are too small to be registered

with NASDAQ OR NYSE register them here and

regulations here are much less than stock

exchanges.

3. Companies on the OTC Markets Group platform

don’t have to file with the SEC to be listed

4. All securities traded over-the-counter are, in reality,

traded by a web of market makers who input

different quotes and trades through a secure

computer network that can only be accessed by

those who subscribe.

Otc Markets Group: It is the owner and

operator of the most substantial U.S. inter-dealer

electronic quotation and trading system for OTC

securities and is publicly traded on the OTCQX

marketplace. It has 3 divisions:

1. Trading Services: connects broker-dealers

together which provides the liquidity and

infrastructure for executing trades on the OTC

market.

2. Market Data: provides data and quote

services for the more than 10,000 OTC securities.

3. Corporate Services: helps companies go

public and gain greater visibility through listing in

one of OTC Markets Group's three OTC tiers.

Why Otc Usa?

1. Greater Visibility In USA

and marketing benefits

2. Fund Raising will be very easy in

USA from Theme based Institutional

investors

3. Greater liquidity through larger

trade volume

4. No disclosure of financial

statements on OTC Pink. Most

Indian companies are also listed.

5. Getting customer feedback by showing

product of the company in a foreign

market

6. Companies like Nestle are also listed

on OTC USA, testimony to its

increasing credibility

TYPES

OTCQX

- Top tier of the three marketplaces for the OTC trading of stocks and stocks that trade on this forum must comply with US security laws.

- They also must hold sponsorship from a third -party financial adviser.

- Penny stocks, shell companies, and companies in bankruptcy cannot qualify for a listing on the OTCQX.

OTCQB

- Middle Tier - Venture Market - Early staged companies are listed here.

- To be listed, all companies must meet a minimum of a $0.01 bid price test. They also must undergo yearly verification to ensure legitimacy

- A certain degree of company information must be available. And these companies report to a US regulator like SEC or FDIC

OTC PINK

Lowest ,most speculative tier. No

disclosure of financial

statements is mandatory in this

segment

It is further divided into 3 parts:

Current Information Companies

those follow IRS and make

filings publicly available through

the OTC Disclosure & News

Service.

Limited Information Include

troubled firms in financial distress,

bankruptcy, or those with

accounting issues.

No Informationcompanies are

those businesses that do not

provide any disclosure at all.

OTC QX

Eligibility Criteria:

- Have U.S. $2 million in Total Assets as of the most recent annual or quarter end;

- As of the most recent fiscal year end, have at least one of the following:

- Be quoted by a market maker on the OTC Link.

- Have its securities listed on a Qualifying Foreign Stock Exchange for a minimum of the preceding 40 calendar days.

- Not be in bankruptcy or reorganization proceedings.

- (i) U.S. $2 million in revenues;

- (ii) U.S. $1 million in net tangible assets;

- (iii) U.S. $500,000 in net income; or (iv) U.S. $5 million in global market capitalization;

OTC QB

Eligibility Criteria:

- Meet minimum bid price test of $0.01 for each of the last 30 calendar days;

- Companies may not be subject to bankruptcy or reorganization proceedings the Company’s application;

- Have at least 50 Beneficial Shareholders, each owning at least 100 shares

- Have a freely traded Public Float of at least 10% of the total issued and outstanding of that security.

- International companies must be listed on a Qualified Foreign Exchange (or SEC Reporting)

OTC PINK

There are no qualitative standards beyond disclosure for OTC Pink companies,

1. Current Information:

- http://www.legalandcompliance.com/se curities-law/otc-market-compliance/otcmarkets-listing-requirements/

- A company must subscribe to the OTC Disclosure & News Service

- One- Time set up fee: $ 500

- Annual fee: $ 4200

2. No Information:

Companies with No Information status on

OTC Markets are delineated by a “stop” sign

and do not provide any current or updated

reliable public disclosure.

3. Limited Information:

- Maintain quarterly and annual reports that are no older than 6 months and that include a balance sheet, income statement and total number of issued and outstanding shares;

- Financial statements must be prepared in accordance with GAAP; and

- The company profile page on OTC Markets must be current and accurate.

- a company must subscribe to the OTC Disclosure & News Service

- One- Time set up fee: $ 500

- Annual fee: $ 4200

Indian Companies Listed On Otc Usa

OTCQX

| COMPANY NAME | INDUSTRY |

|---|---|

| Mahanagar Telephone Ltd | Telephone Comm. |

| Yatra Online.Inc | Transportati on Services |

OTC PINK- NO INFORMATION

| COMPANY NAME | INDUSTRY |

|---|---|

| Axis Bank Ltd | Banking |

| Farm Lands Of Africa Inc | Prepackaged Software |

| Larsen & Toubro Ltd | Engineering & Construction |

| Tripborn Inc | Transportation Services |

| Rediff.com India Ltd | Data Processing & Preparation |

| Reliance Ltd | Conglomerate |

| Mahindra & Mahindra Ltd | Vehicle Manufacturing |

OTC PINK- CURRENT INFORMATION

| COMPANY NAME | INDUSTRY |

|---|---|

| Groupe Athena Inc | Services, Misc. |

| State Bank Of India | Banking |

Singapore Stock Exchange

Why Singapore?

1. Political stability and excellent business environment

2. Asian gateway of clusters and business opportunities

3. Access to institutional investors - the biggest international stock exchange in Asia whereby 40% of

listed companies are foreign

4. Quick and efficient fundraising process with certainty of timing

5. Sector strengths that are well tracked and understood by investors

6. International disclosure and corporate governance standards

Taxation In Singapore

| Income | Tax Rate |

|---|---|

| Tax Rate on corporate profits for upto 300000 SGD | Effective Tax Rate at 8.5% |

| Tax rate on corporate profits for above 300000 SGD | 17% |

| Tax rate on Capital Gain accrued by the company | 0% |

| Tax rate on dividend distribution to shareholders | 0% |

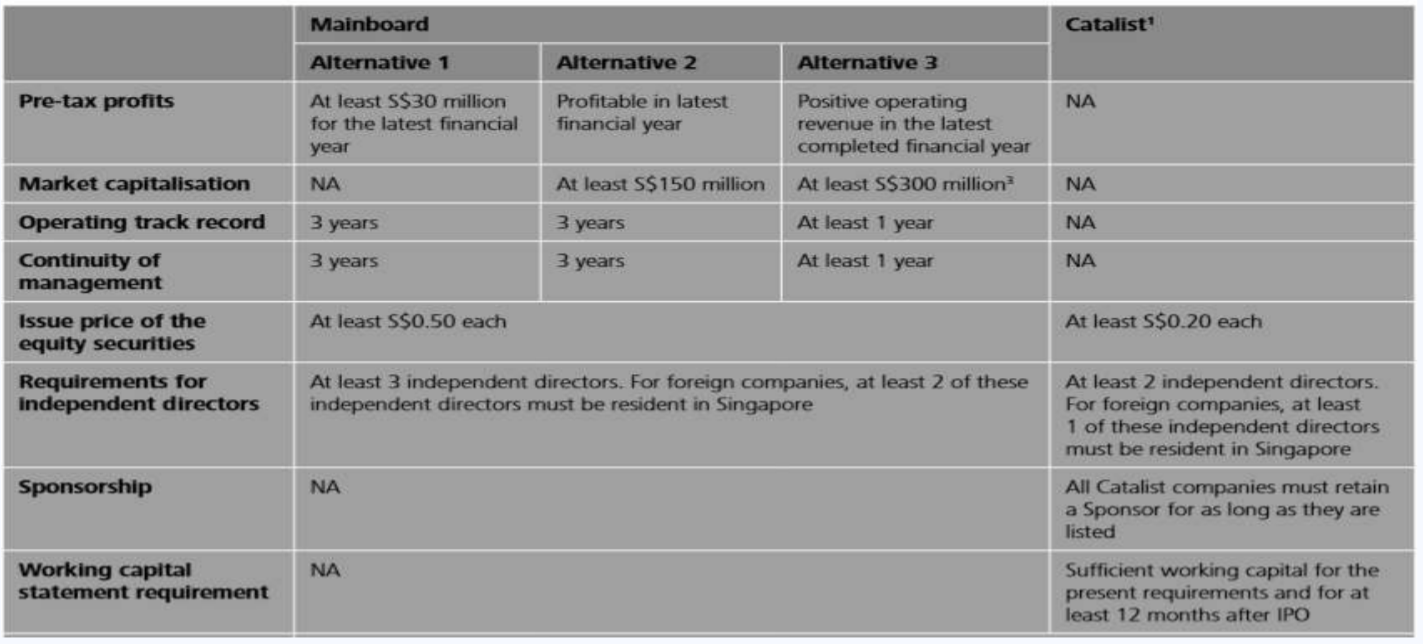

TYPES

Mainboard

- In Mainboard Listing, companies are required to meet certain quantitative requirements to get listed

- Mainboard-listed companies enjoy the prestige of an established market place and access to the widest range of institutional and retail investors.

Catalist

- In Catalist Listing, companies do not require to have quantitative requirements but needs to appoint a sponsor, who will assess its suitability to list and will advise and guide the company through the listing process. The company must maintain the sponsor at all times after listing.

Continued....

Mainboard Listing Fees

| Listing Fees | |||

| Initial Fees | Annual Fees | ||

| Minimum | $$100000 | Minimum | $$35000 |

| Minimum | $$200000 | Minimum | $$150000 |

| Variable Rate per $$million Basic | $$100 Market Value | Variable Rate per $$million Basic | $$30 |

| Processing Fees (Non-Refundable) | $$20000 | Market Value | |

Catalist Listing Fees

| Listing Fees | |||

| Initial Fees | Annual Fees | ||

| Minimum | $$30000 | Minimum | $$15000 |

| Minimum | $$100000 | Minimum | $$50000 |

| Variable Rate per $$million Basic | $$100 Market Value | Variable Rate per $$million Basic | $$25 |

| Processing Fees | $$2000 | Market Value | |

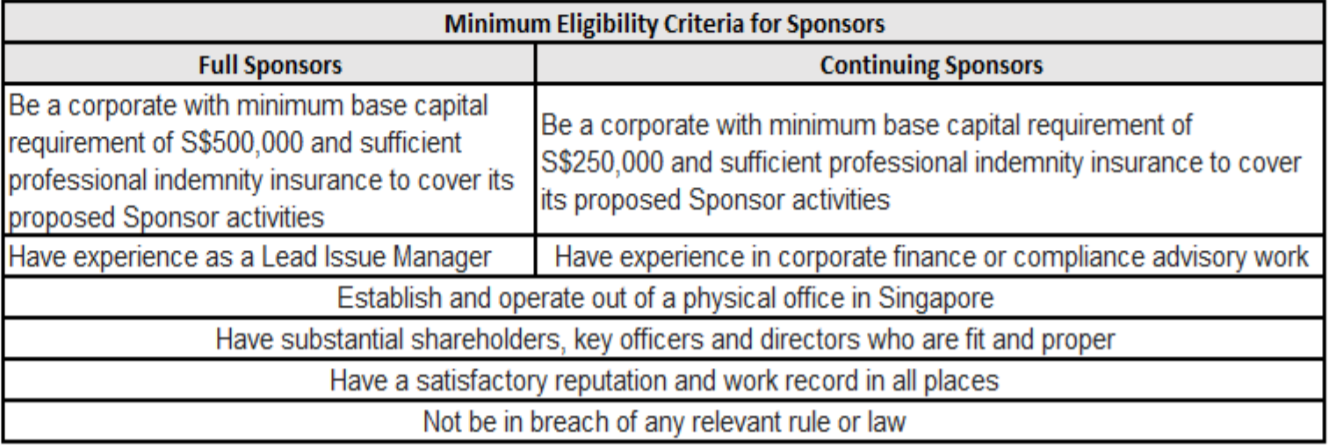

Sponsors & Companies In Catalist Listing

- Sponsors are authorised and regulated by SGX through strict admission criteria and subject to continuing obligation under the Catalist Rules.

- Sponsors assess the suitability of companies to list on Catalist and ensure that the listed companies comply with their continuous listing obligations. A Sponsor may be authorised by SGX to act as a Full Sponsor or as a Continuing Sponsor

- Full Sponsors may engage in:

- Continuing Sponsors will only be authorised to undertake Continuing Activities.

- Pre-listing Activities: i.e. activities related to bringing an applicant to list on Catalist.

- Continuing Activities: i.e. activities relating to sponsorship of issuers who are already listed on Catalist.

Eligibility Criteria For Sponsors

London Stock Exchange

Why London?

1. Provide access to capital for growth

2. Exchange is the largest stock exchange in Europe and the world's most internationally focused

3. London is well known for its high standards of regulation

4. Obtain an objective market value

5. Increase a company's ability to make acquisitions

6. Enhance status with customers and suppliers

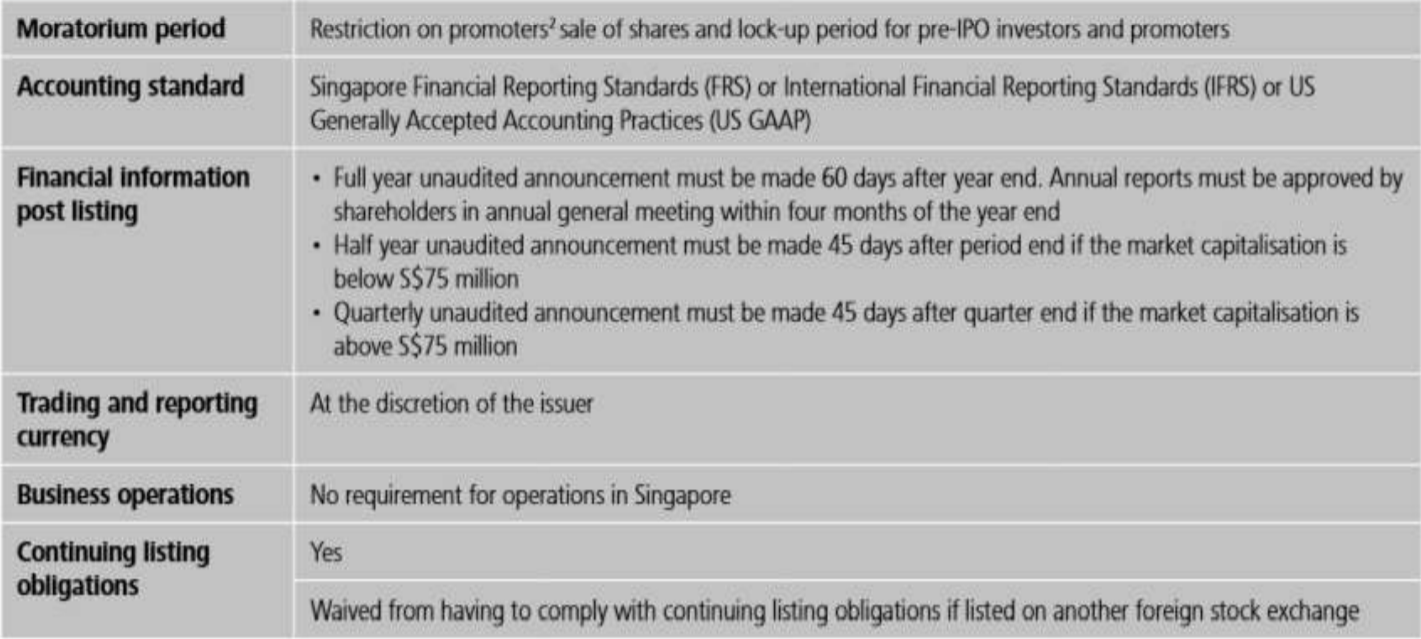

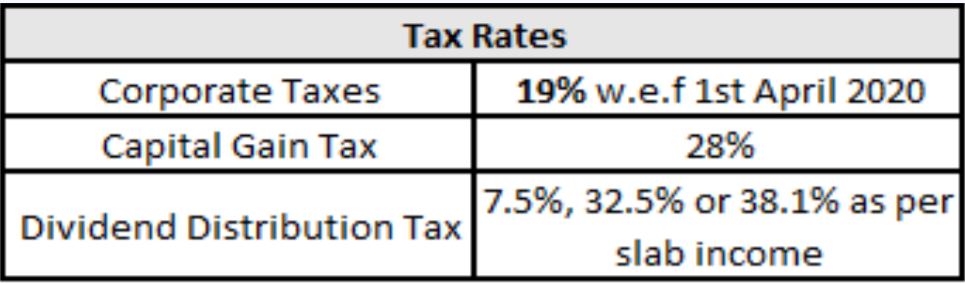

Taxation In London

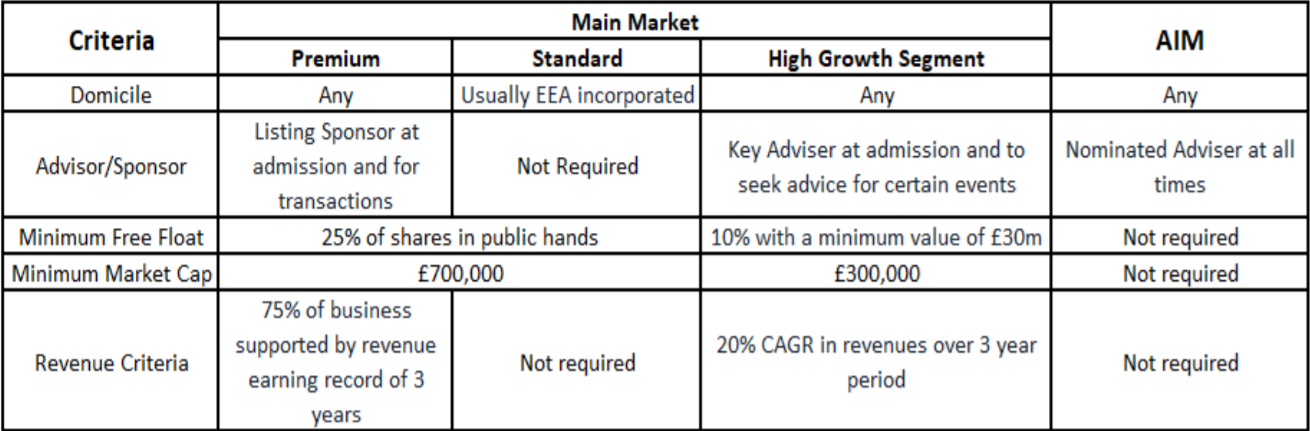

TYPES

Main Market-High Growth Segment

- The High Growth Segment (HGS) is a segment of London Stock Exchange’s Main Market. It is a transitional segment designed to attract high growth, mid-sized UK and European companies aspiring to an Official Listing on the Premium Segment over time.

Standard Main Market

- Standard listings cover issuance of shares, Global Depositary Receipts (GDRs), debt and securitised derivatives that are required to comply with EU minimum requirements

Premium Main Market

- Only available to equity shares and closed- and openended investment entities

- Only available to equity shares and closed- and openended investment entities Issuers with a premium listing are required to meet the UK’s Listing Rules, which are more onerous than the EU minimum requirements

AIM

- AIM offers smaller growing companies from all countries and all sectors all the benefits of being traded on a world-class public market within a regulatory environment designed specifically for them

Requirements For All Types Of Market

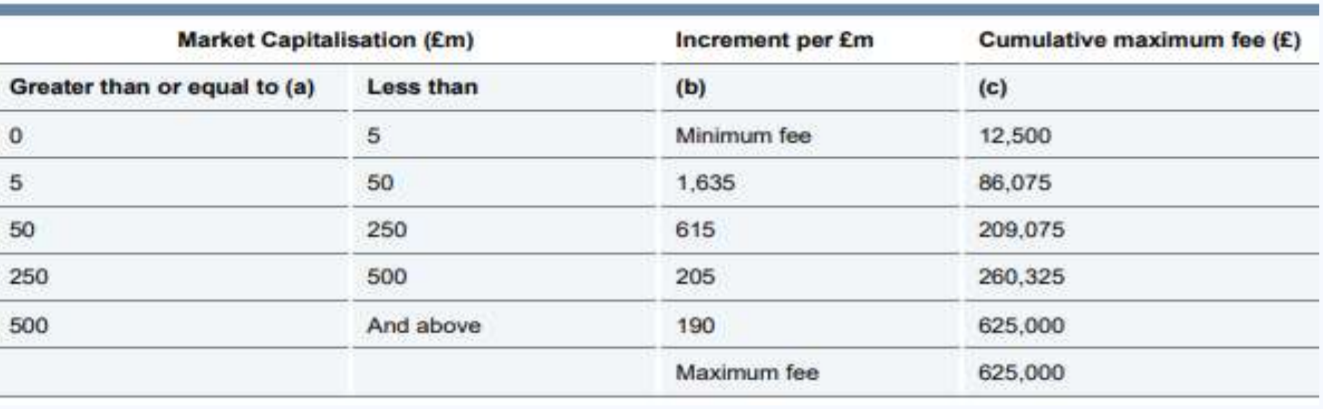

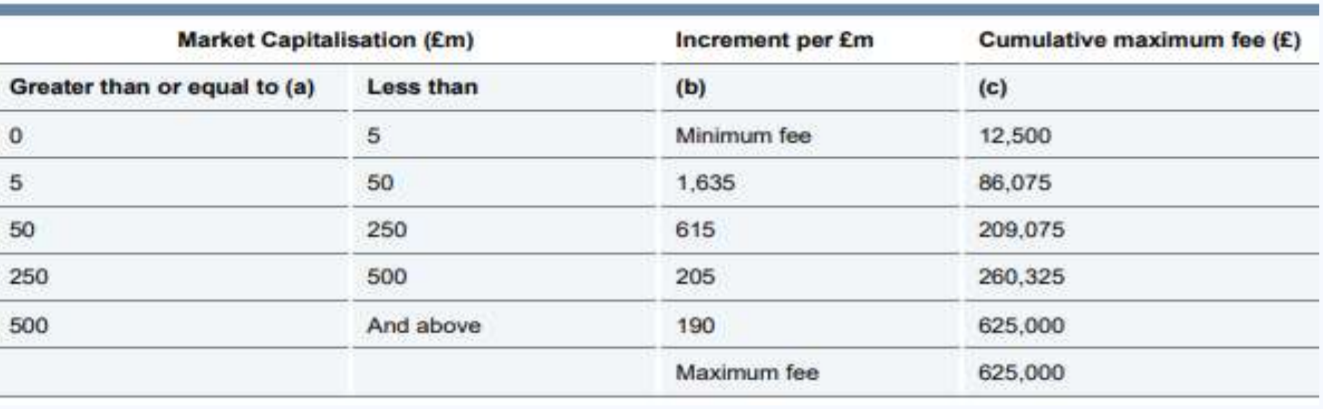

Listing Fees